The recent Chocolate Finance meltdown has ignited a critical discussion in Singapore’s financial landscape regarding the distinctions between banks and fund managers. As the company faced scrutiny for its operations, it underscored the urgent need for regulatory clarity in the financial sector, particularly for firms that straddle the line between traditional banking and investment management.

Chocolate Finance, which aimed to simplify financial services with a consumer-friendly approach, has been a notable player in Singapore’s innovative finance scene. However, the recent turmoil raised questions about its classification and the regulatory framework that governs such entities. The monetary authority of Singapore has emphasized the necessity for clear definitions and stringent regulations to protect investors and maintain market integrity. This incident has prompted calls for a reevaluation of how financial services are categorized, particularly as technology-driven solutions continue to reshape the industry.

The broader financial environment is also feeling the effects of significant volatility, particularly in commodity markets. The cocoa market, for instance, is grappling with historical highs in prices due to a global shortage exacerbated by climate change and supply chain inefficiencies. This situation is not just a concern for chocolate manufacturers but also for investors who are increasingly wary of the implications of such volatility on their portfolios. As cocoa prices remain elevated, the potential for inflation in the chocolate market looms large, raising further concerns about ethical practices within the supply chain.

Moreover, the challenges surrounding child labor in the cocoa industry have drawn attention from investors who are advocating for greater transparency and ethical labor practices. Despite initiatives like Child Labor Monitoring and Remediation Systems (CLMRS), significant gaps persist in ensuring fair wages and safe working conditions for cocoa farmers. This highlights a growing trend among investors to engage with companies on social responsibility issues, reinforcing the importance of ethical considerations in investment decisions.

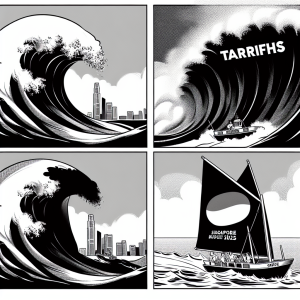

As Singapore navigates these complexities, the financial sector must adapt to the evolving landscape. The interplay between market volatility, regulatory clarity, and ethical investment practices will be crucial in shaping the future of finance in the region. The Chocolate Finance incident serves as a pivotal reminder of the need for a well-defined regulatory framework that can accommodate the innovative approaches emerging in the financial sector while safeguarding investor interests and promoting sustainable growth.